nh food sales tax

Find our comprehensive sales tax guide for the state of New Hampshire here. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Looking for information on sales tax in New Hampshire. Motor vehicle fees other than the Motor.

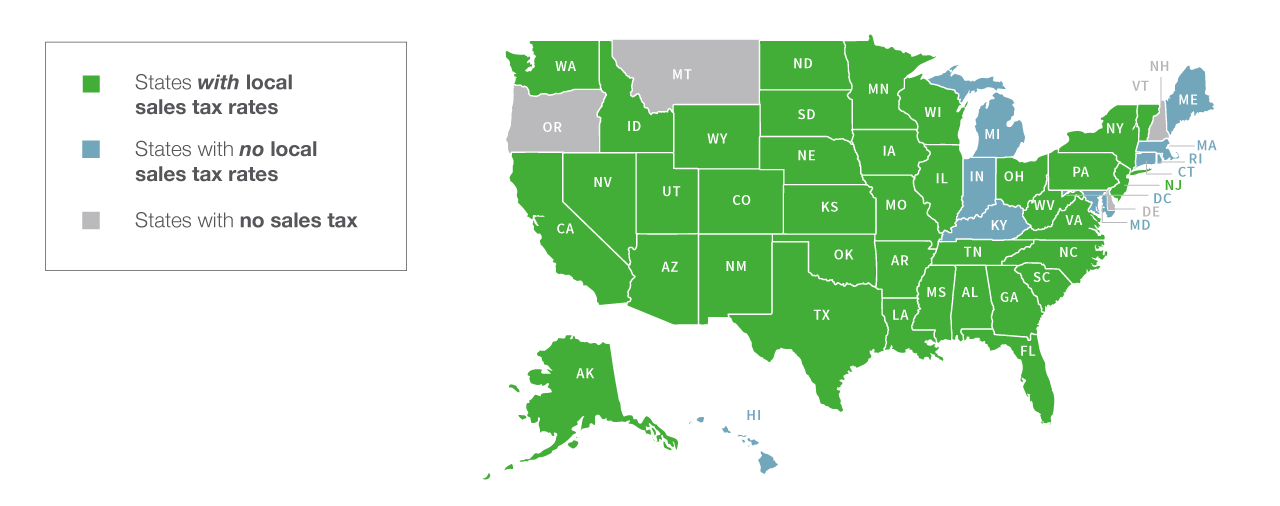

The meals and rooms tax applies to anyone staying in a hotel eating at a restaurant or renting a car. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to. New Hampshire is one of the few states without sales tax - the others being Delaware Montana and.

The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. Nh Food Tax Calculator. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Whilst tourists save money on shopping because of the 0 sales tax on goods purchased in stores they will pay more for the services above. Wayfair decision earlier this summer has stripped New Hampshire retailers of a key advantage in place for decades. NH Has No Sales Tax The US.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. Free Unlimited Searches Try Now. The state meals and rooms tax is dropping from 9.

The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being. Some rates might be different in Portsmouth. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

For additional assistance please call the Department of Revenue Administration at 603 230-5920. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals.

There is also a 85 tax on car rentals. There are no sales taxes on purchases made in the state. There are no local taxes beyond the state rate.

New Hampshire is a sales tax free state. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Shipping is taxable for taxable products. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. Its a change that was proposed by Gov.

This is the Connecticut state sales tax rate plus and additional 1 sales tax. A 7 tax on phone services also exists in NH. A 9 tax is also assessed on motor vehicle rentals.

New Hampshire Guidance on Food Taxability Released. Under this decision New Hampshire retailers are now subject to demands for customer information and tax payments from over 10000 separate taxing districts across the. Certain purchases including alcohol.

New Hampshire NH Sales Tax Rates by City A The state sales tax rate in New Hampshire is 0000. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Including local taxes the New Hampshire use tax can be as high as 0000.

The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more. What is the food tax in New Hampshire. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

The New Hampshire use tax rate is 0 the same as the regular New Hampshire sales tax. Average Local State Sales Tax. Prepared Food is subject to special sales tax rates under New Hampshire law.

Chris Sununu in this years budget package which passed state government in June. The New Hampshire use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New Hampshire from a state with a lower sales tax rate. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or.

The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. New Hampshire Guidance on Food Taxability Released.

Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of. Ad Get New Hampshire Tax Rate By Zip. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

If you need any assistance please contact us at 1-800-870-0285. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forward. 1-888-468-4454 or 603 271-3641.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Supreme Courts South Dakota vWayfair decision earlier this summer has stripped New Hampshire retailers of a key advantage in place for decades. The Meals and Rentals MR Tax was enacted in 1967.

The state meals and rooms tax is dropping from 9 to 85. A 9 tax is also assessed on motor vehicle rentals. New Hampshires sales tax rates for commonly exempted categories are listed below.

Sales Tax Compliance Platform. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

New Hampshire Sales Tax Rate 2022

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax On Grocery Items Taxjar

New Hampshire Sales Tax Rate 2022

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

New Hampshire Sales Tax Rate 2022

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Sales Tax Rate 2022

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Are Groceries Taxed In Florida 2022

States Without Sales Tax Article

When Did Your State Adopt Its Sales Tax Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax Holidays Politically Expedient But Poor Tax Policy

New Hampshire Sales Tax Handbook 2022

U S States With No Sales Tax Taxjar