vermont sales tax on cars

In Vermont the state tax rate of 6 applies to all car sales but the total tax rate includes county and local taxes and can be up to 7. The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxation.

Used Cars Trucks Vans Suvs For Sale In Middlebury Vt Stone Chrysler Dodge Jeep Ram

You can find these fees further down on the.

. The base state sales tax rate in vermont is 6. Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information provided in. This guide is intended to provide an overview only.

32 VSA 9741. Tax imposed a 1 There is hereby imposed upon the purchase in Vermont of a motor vehicle by a resident a tax at the time of such purchase payable as hereinafter provided. You can find these fees further down on the.

You can then fill out the Vermont Motor Vehicle RegistrationTaxTitle Application and submit all of the required documents including the bill of sale to the DMV. Average Sales Tax With Local6182. The VT sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

The base state sales tax rate in vermont is 6. Taxability of Goods and Services What transactions are generally subject to sales tax in Vermont. Local option tax is a way for municipalities in Vermont to raise additional revenue.

Vermont state sales tax rate range 6-7 Base state sales tax rate 6 Local rate range 0-1 Total rate range 6-7 Due to varying local sales tax rates we strongly recommend using. In the state of Vermont sales tax is legally required to be collected from all. A municipality may vote to levy the following 1 local option taxes in addition to state business.

Vermont collects a 6 state sales tax rate on the purchase of all vehicles. Act 194 S276 Secs. You can find these fees further down on the page.

Customers who purchase new or used clean alternative fuel or hybrid vehicles may qualify for a sales and use tax exemption if the vehicle is delivered to them between August 1. For vehicles that are being rented or leased see see taxation of leases and rentals. There are a total of 155 local tax.

Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153. You can find these fees further down on the page. Vermont Car Vehicle Bill.

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. The average total car sales tax in. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax.

Vermonts sales tax rates for commonly exempted items are as follows. Exemption for Advanced Wood Boilers. You are required to select the type of ownership.

In addition to taxes car.

New Toyota Tacoma South Burlington Vt

Nj Car Sales Tax Everything You Need To Know

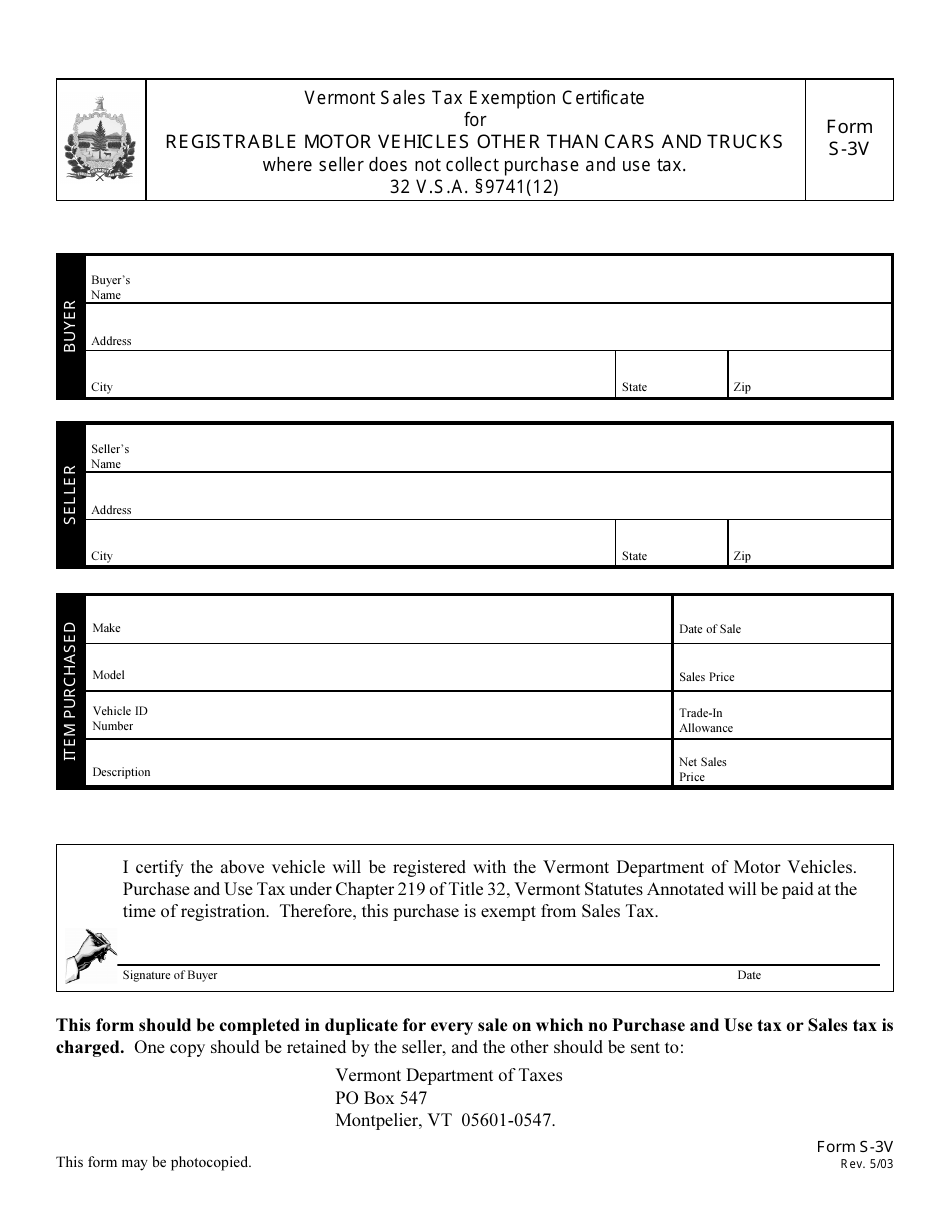

Form S 3v Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Registrable Motor Vehicles Other Than Cars And Trucks Vermont Templateroller

Used Cars Trucks And Suvs For Sale In Vermont 802usedcars Com

Used Jeep For Sale In Vermont Cargurus

Used Cars For Sale Near Burlington Handy Toyota St Albans

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

How To Calculate Sales Tax For Vermont Title Loophole Cartitles Com

South Burlington Considers Sales Meals And Rooms Tax Increase

New Mitsubishi Cars Suvs At Quality Mitsubishi Near Burlington Vt

Used Cars For Sale In Montpelier Vermont Mcgee Ford Of Montpelier

Used Cars For Sale In Vermont Edmunds

New Kia Inventory For Sale In Montpelier Vt Preston S Kia Near Burlington Vt

Vermont Sales Tax Small Business Guide Truic

Used Volvo Cars For Sale In Burlington Vt Cars Com

Electric Vehicles Are All The Buzz In Vermont Environment Seven Days Vermont S Independent Voice

Out Of Stater Car Buying Info Rutland Subaru Ny Nh Ma Beyond